Progress in 2024

Governance

We are utilizing an internally developed set of KPIs that were developed within our organization to help management understand priorities of employees, Mercuria’s impacts and to enhance our ESG strategy.

The Corporate Responsibility & Compliance newsletter, sent regularly to all Mercuria employees since 2019, has become the main communication tool throughout the company on ESG initiatives, strategy and developments. This newsletter includes information about Mercuria’s policies and procedures, relevant regulatory changes, market events, as well as lots of information on important activities around the company.

In recognition of the importance of defining material issues impacting the company, we continue to conduct a survey which seeks employees’ views on a set of ESG topics to create Mercuria’s Materiality matrix. The survey is based on the GRI standards because of their good definition of ESG metrics and adapted to meet our own requirements.

Finally, we are continuing to look at the different themes (governing purpose, quality of governing body, stakeholder engagement, ethical behaviour or risk and opportunity oversight) in order to consider all aspects of the Governance pillar in our sustainability strategy. We continue to enhance and add additional KPIs in order to improve our performance and our reporting.

Materiality matrix

In 2024, Mercuria expanded its approach to Materiality Analysis to reflect a broader, more inclusive perspective on environmental, social and governance (ESG) topics. Building on our previous GRI-based approach, this year’s assessment also aligned itself more closely with the suggested material topics outlined in the European Sustainability Reporting Standards (ESRS), particularly those in ESRS 1 Appendix AR 16. Many of the sustainability matters included continue to reflect the priorities of the Agenda 2030 for Sustainable Development as in previous years.

In addition, this year we adopted a multi-stakeholder approach. Our analysis considered the potential impacts, risks, and opportunities across our operations, including an analysis of the due diligence requests we receive from counterparties, banks and partners to better understand external expectations and views on ESG topics that are material to Mercuria. We also conducted our annual employee survey to ensure internal perspectives remain part of our process. The survey is anonymous to ensure the integrity of responses.

The broader scope allowed us to gain insights into the most relevant topics to Mercuria from multiple stakeholders’ perspectives. In parallel, we continue to update our climate-related risks and opportunities in line with the TCFD framework as we grow our business into new trade / operation streams and publish the results, offering a view into potential financial material risks and opportunities.

This enhancement in approach strengthens our understanding of what topics are most material to our business, helps us align our strategy accordingly and prepares us for future regulatory developments.

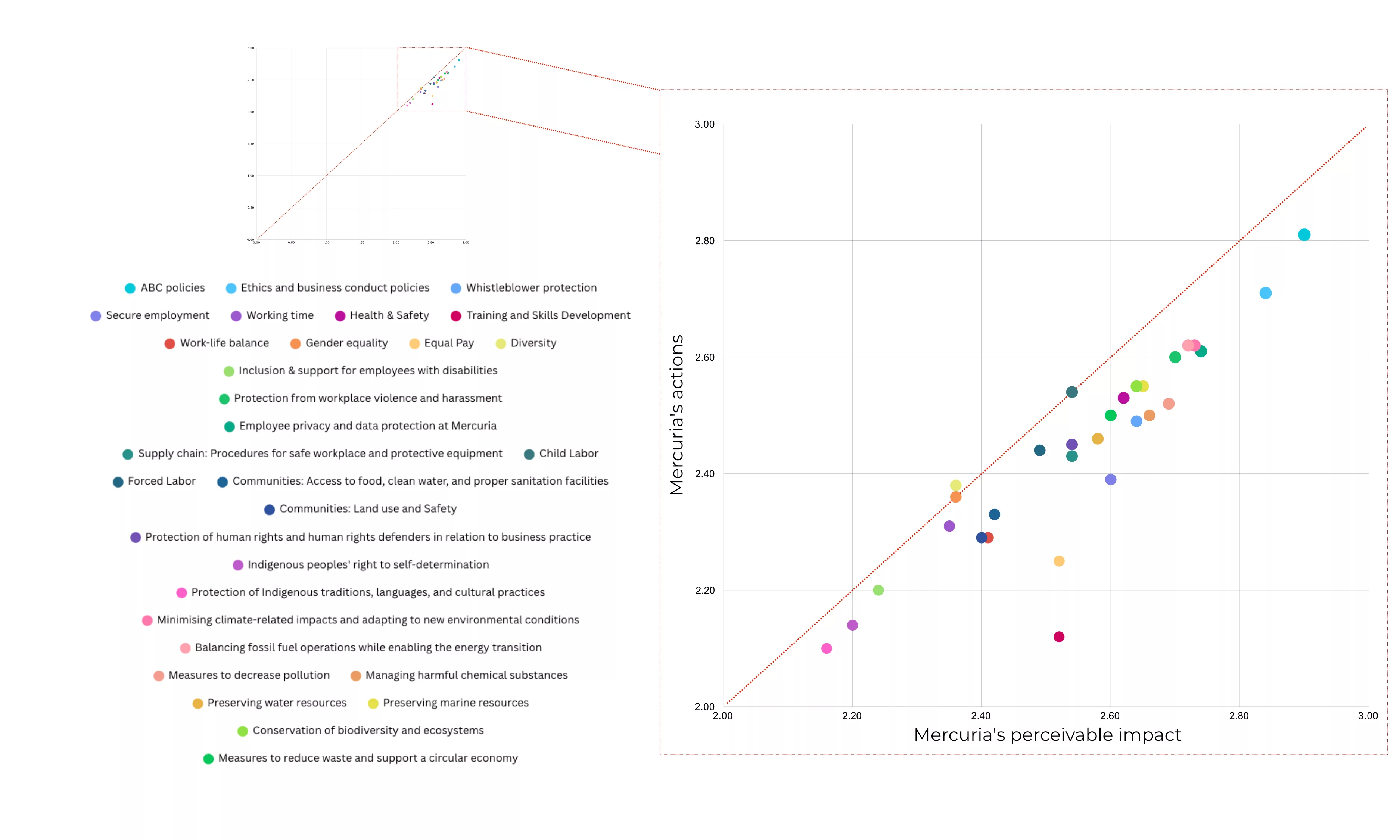

The first figure presents the results of the employee survey. Employees assessed how well Mercuria is addressing various material topics (y-axis) relative to how important these topics are to the company (x-axis). Each topic was rated on a scale from 0 (not relevant / not material) to 3 (material and strategy-defining). All topics received scores above 2, indicating that employees consider them material to Mercuria. Most data points align closely with the diagonal line, suggesting that Mercuria’s performance generally matches employees’ expectations. The positioning just below the diagonal highlights that employees hold the company to high standards—pointing to opportunities for continuous improvement.

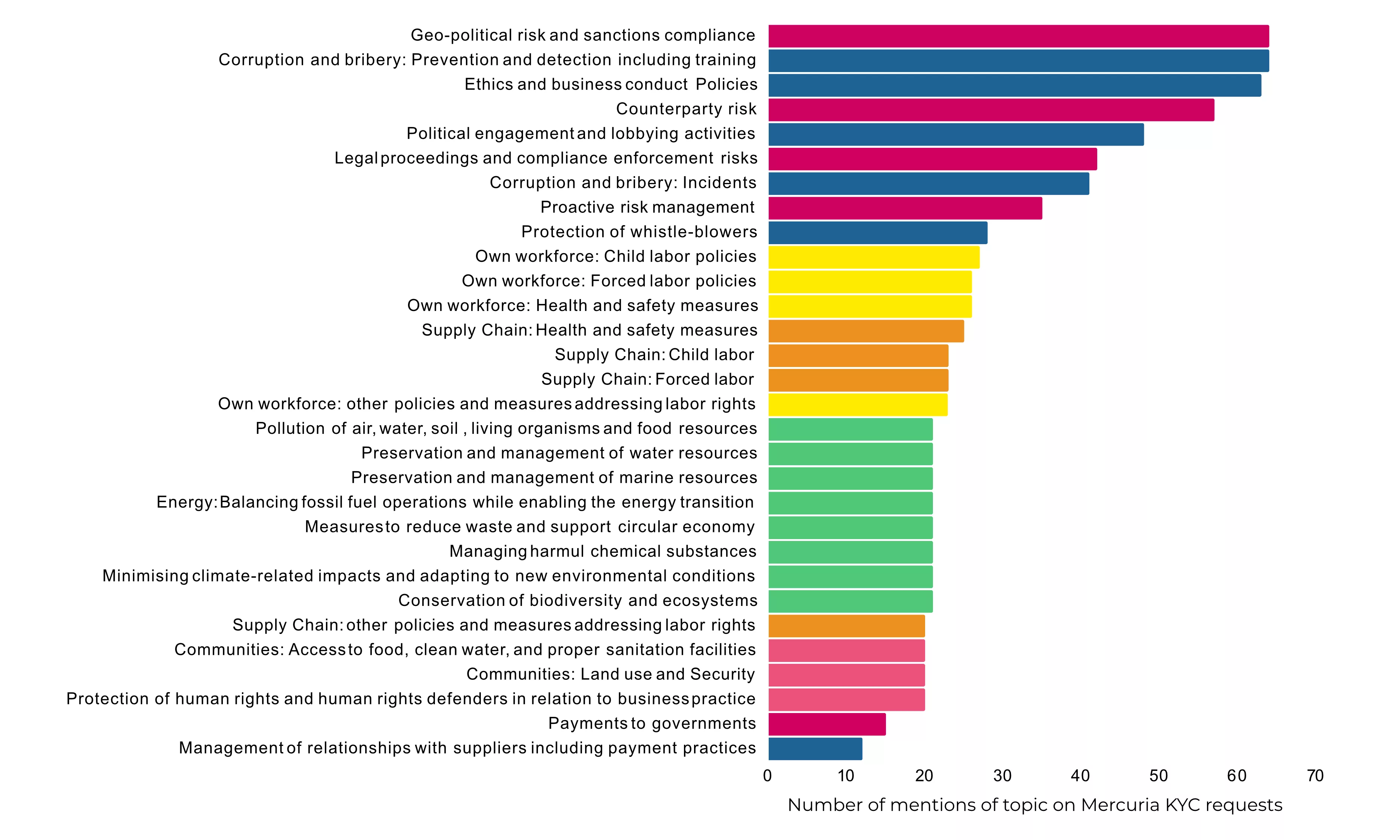

The second figure shows the results of the due diligence requests analysis we receive from counterparties, banks and partners. This analysis provides insight into which material topics are most important from the perspective of external stakeholders.

Geopolitical risks—including sanctions—and the prevention of corruption and bribery prevention and detection rank as the most material, underscoring their critical importance. Other high-priority compliance topics include ethics and business conduct policies, counterparty risks, political engagement, and corruption incidents, which reflect the regulatory and reputational risks companies face in today’s complex geopolitical environment and the increasing scrutiny from financial institutions and corporate clients.

Human rights risks also feature prominently, both in relation to our operations and our supply chain—particularly regarding forced labor, child labor, and health and safety. Additional material topics identified include pollution, natural resource management, product portfolio balance, community protection, and transparency around payments to governments.

These results provide a clear overview of the material topics for Mercuria—areas we continue to strive and to improve each year. We have also compared the perspectives of our employees with those of the external stakeholders. We observe an alignment in the topics considered most material to the company. The key difference lies in employees placing greater emphasis on areas relating to them such as training, career development, work-life balance and equal treatment.

Payments to governments

As part of its Anti-Bribery and Anti-Corruption Policy, Mercuria prohibits the payment of facilitation fees. Mercuria takes care to ensure that any fees being paid to a government agency in relation to deals are legitimate payments and not facilitation payments.

Below you can find information on the payments that Mercuria has made to governments in relation to our extraction facilities.

* Specific tax for energy companies with the purpose to tax the extra-profit made due to significant price increases

The consolidated overview presented above discloses the sum of the Group’s payments to governments in each country where the Group had extractive operations. The overview is based on the location of the receiving government.

About Payments to Governments in 2024

This report has been prepared in line with the Swiss Code of Obligations and the EU Accounting Directive 2013/34/EU, as amended which has been transposed into Cyprus legislation. The report’s publication aims to provide for enhanced transparency of payments made to governments in the context of extractive and harvesting activities.

Article 964d of the Swiss Code of Obligations states that “Companies that are required by law to undergo an ordinary audit and which are either themselves or through a company that they control involved in the extraction of minerals, oil or natural gas or in the harvesting of timber in primary forests must produce a report each year on the payments they have made to state bodies.”

Article 42 of Directive 2013/34/EU states that “Member States shall require large undertakings and all public interest entities active in the extractive industry or the logging of primary forests to prepare and make public a report on payments made to governments on an annual basis.” The provisions of this EU Directive are integrated in 13th Schedule of the Companies Law, Cap 113 in Cyprus.

Basis of Preparation and Scope

Mercuria Energy Group Ltd as parent of the Mercuria group of companies (the “Group”) has prepared the report on a consolidated basis and reports the activity of any of its subsidiary undertakings that perform extractive operations. Taxes, royalties, license fees, production entitlements and infrastructure improvements to governments are presented as incurred during the reporting period.

This report includes all payments to governments for activities which relate to exploration, discovery, development and extraction of minerals and other materials resulting from extractive operations of each of the Group’s consolidated subsidiaries during the financial year of 2024 (from 1 October 2023 to 30 September 2024).

Payments made to a government as a single payment or as a series of related payments of EUR 100,000 or more in financial year 2024 form part of this report.

This report excludes payments by non-consolidated entities (such as those that are accounted for using the equity method) regardless of the amounts paid and also excludes payments to governments related to the processing, marketing and trading of any of the Group’s products. Equally, any donations made, for example in respect of social or community programs, are excluded.

Unless otherwise noted, the following terms have the meanings as explained below:

Government

Any national, regional or local authority of a country, and includes a department, agency or other undertakings controlled by that authority.

Materiality Payments

Payments made as a single payment exceeding EUR 100,000 or as part of series of related payments within a financial year exceeding EUR 100,000.

Reporting Currency

All payments have been reported in USD.

Amounts in currencies other than USD (presentation currency for this report) have been converted based on the average annual foreign exchange rates prevailing as of September 30, 2024.

Payment Types

“Payment” is defined as an amount paid whether in cash or in kind, for relevant activities where the payment is of any one of the types listed below:

Production Entitlements/Rights

Represents host government’s share of production. This payment is generally made in kind.

Taxes

Represents taxes levied on the income, production or revenues or profits of a consolidated subsidiary, excluding taxes levied on consumption such as value added taxes, personal income taxes or sales taxes. Where practical, we have reported the amounts associated with the extractive operations only. Tax payments are made in accordance with current local regulations, which may include instalments.

Royalties

Represents percentage of production payable to the owner of the mineral rights.

Fees

Represents license fees, surface or rental fees, and other consideration for licenses and / or concessions paid for access to the area where extractive operations are conducted.

Infrastructure Improvements

Represents payments for local development, including the improvement of infrastructure, not directly necessary for the conduct of extractive operations but mandatory pursuant to the terms of a production sharing contract or to the terms of a law.

Continue reading

← 2024 in numbers

Planet in 2024 →

Reporting areas

Governance

Planet

People

Prosperity