Overview

Our activities

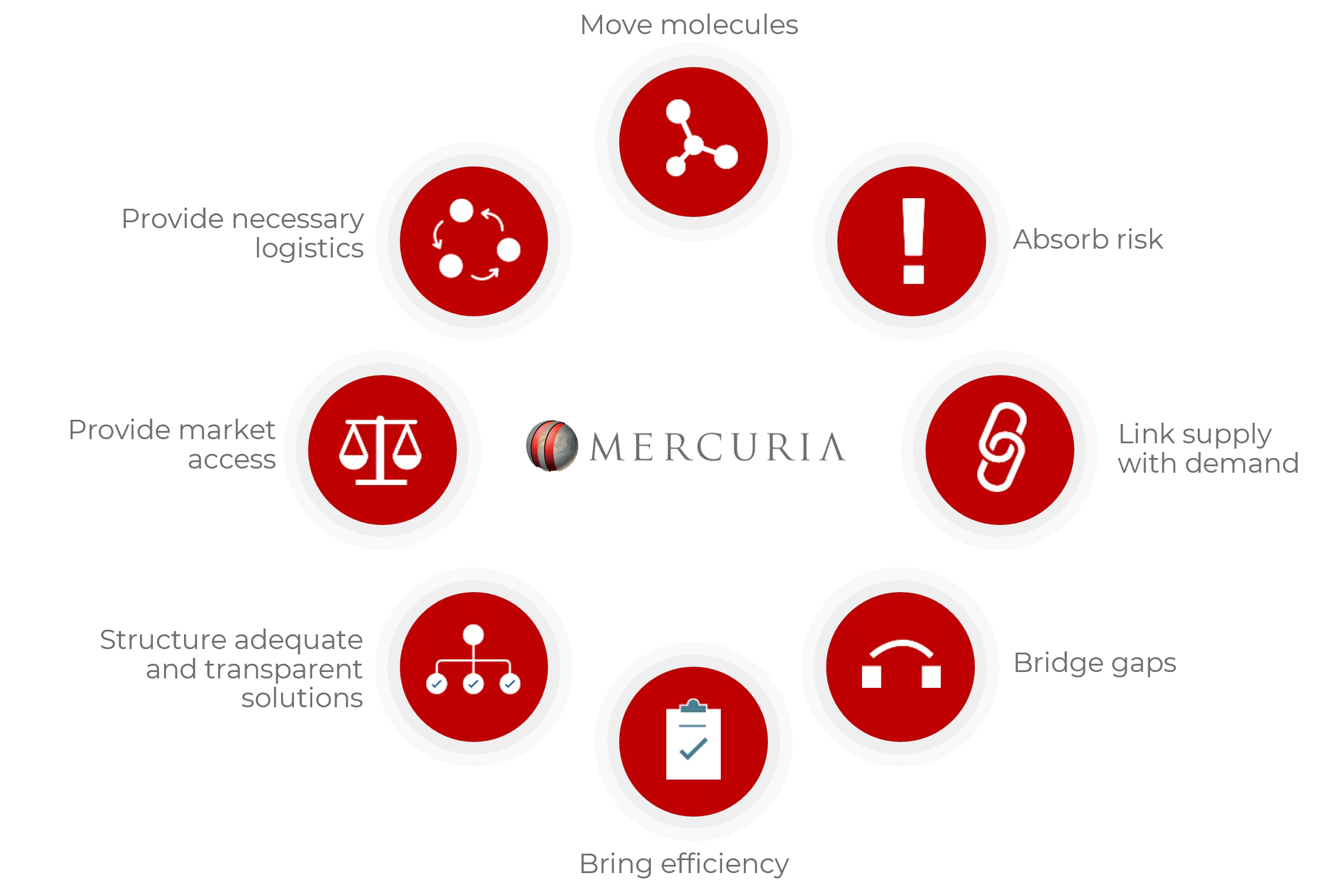

With global operations, responsible sourcing practices, and deep expertise in the commodity supply chain, Mercuria is well-positioned to connect supply with demand, transform products, and efficiently operate infrastructure and logistics network.

This end-to-end oversight enables us to fully support our partners and manage risks across the entire supply chain. As a result, our counterparts view us as a trusted and strategic service provider.

The physical commodity market is a dynamic and complex environment, characterized by price discrepancies and inefficiencies across regions and timeframes. Mercuria’s core expertise lies in identifying and addressing these disparities, acting as a bridge that helps rebalance market fundamentals and optimise value for our clients.

We leverage our comprehensive understanding of market dynamics and logistical factors to implement various arbitrage strategies.

These include:

- Geographic arbitrage: Identifying price differences between geographically separate markets and facilitating the efficient movement of commodities between them.

- Technical arbitrage: Opportunities that arise from variations in transportation, storage, and processing costs to optimise the value chain.

- Time arbitrage: Commodity storage to balance supply and demand across different time periods.

- Contractual arbitrage: Creating value by strategically managing diverse contractual structures and pricing mechanisms.

At the core of our expertise lies a diversified portfolio of assets positioned in strategic locations. These include logistics terminals, bio-refineries, metal warehouses, and upstream ventures in key commodity sectors. These physical assets provide us with the operational flexibility and logistical control necessary to execute our strategies with precision and efficiency.

Furthermore, we actively collaborate with stakeholders across the energy spectrum, facilitating the integration of emerging renewable energy sources like solar and wind into the existing power grid. By connecting established and alternative energy sources, we help drive a more sustainable and secure energy future.

Mercuria’s role also goes beyond just trading. We provide comprehensive solutions to manage the challenges of a dynamic commodity market, deliver optimal value to our clients while contributing to a more sustainable future.

Global footprint

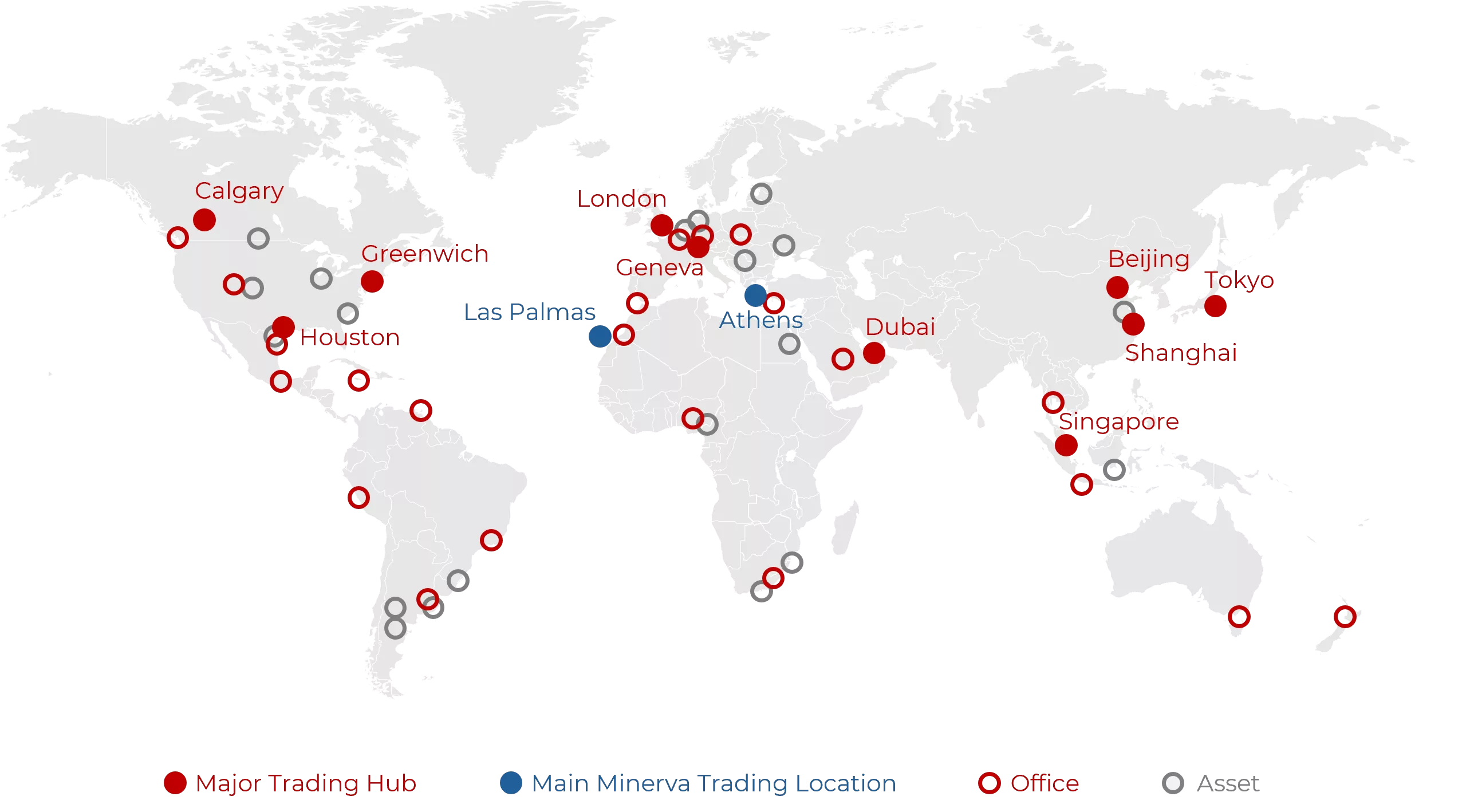

At Mercuria, we believe proximity is a differentiator. Maintaining a strong physical presence in key locations across the globe is not only about convenience; it is fundamental to our ability to deliver superior service and value to our customers. By being close to both producers and consumers, we gain deeper market insights and real-time intelligence on product flows, logistics, and fundamental factors that influence the market.

This adjacency also strengthens our position by allowing us to optimise the supply chain through our strategic network of assets. We leverage our own terminals, storage facilities, and blending capabilities to efficiently move, store, and optimise the flow of various commodities. When needed, we seamlessly tap into third-party infrastructure, ensuring flexibility and access to the most advantageous routes and resources.

To keep pace with evolving market dynamics and customer needs, we actively adapt and expand our global presence. We have strategically opened new offices in key regions and strengthened our existing representative network to deepen our local connections. This ongoing geographical diversification allows us to quickly react to market shifts and opportunities worldwide, while ensuring consistent, high-quality service across all locations.

Mercuria’s presence extends beyond an extensive network of offices; it encompasses a deep operational footprint in more than 50 countries. Our regular activity across diverse geographies and markets provides us with invaluable industry intelligence and a comprehensive understanding of global trends. Our robust data insights and deep market expertise enable us to identify key short-, medium-, and long-term trends, adapt our business model to meet evolving customer needs, and remain ahead of the curve in an ever-changing market landscape.

Our global operation is structured around three major trading hubs: Europe, Middle East, and Africa (EMEA), Asia and the Americas. Each hub acts as a multi-product powerhouse, fostering diversification and a holistic approach to regional markets. This structure guarantees not only a deep understanding of local intricacies but also immediate responsiveness to situations anywhere in the world, ensuring we consistently deliver on our commitment to customer excellence.

By prioritizing proximity, agility and deep market intelligence, Mercuria positions itself as a trusted partner for businesses navigating the complexities of the global commodity market. We go beyond just trading; we build trusted relationships and provide comprehensive solutions that optimise supply chains, deliver value and empower our customers to thrive in a dynamic global environment.

What we trade

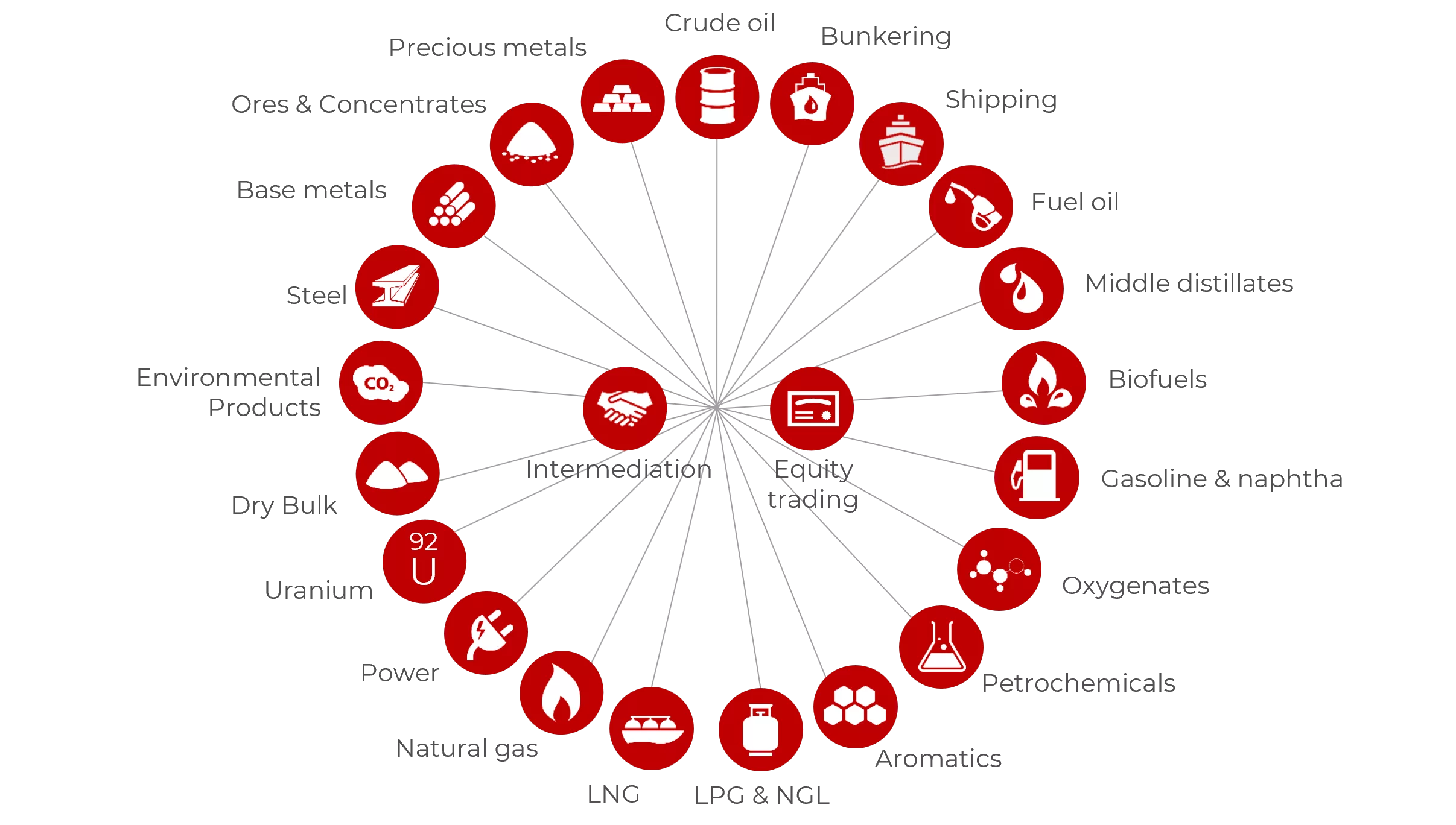

Mercuria has evolved significantly over the past two decades, from a focus on crude oil trading to trading a portfolio of diversified energy and environmental products. Today, our portfolio spans a wide range of commodities, including:

- Energy: Biodiesel, natural gas, power, liquefied natural gas (LNG), refined products, and crude oil.

- Environmental products: Carbon credits, renewable energy certificates and other sustainability instruments.

- Dry bulk and soft commodities: Iron ore, coal, grain, and other physical commodities.

- Metals: Copper, aluminium, zinc, and other metals, including transition metals.

This diversification is central to our strategy. Operating across multiple, often iterconnected commodity sectors provides us with several key advantages, including:

- Resilience: Our diversified portfolio provides a built-in safeguard against market volatility. When adverse conditions affect one segment, we can draw on strength in others to mitigate risk and maintain overall stability. This strategic diversification acts as a natural hedge, reinforcing the foundation for long-term, sustainable growth.

- Agility: With expertise and presence across diverse markets, we are able to quickly adapt to shifting trends and capitalize on emerging opportunities. Our cross-commodity knowledge enables us to identify synergies and deliver integrated solutions—unlocking new pathways for value creation.

- Market Insights: Our multi-dimensional view of the global commodity landscape offers invaluable market intelligence. By analysing and cross-referencing data across sectors, we gain a deeper understanding of underlying trends and are better positioned to anticipate market movements with accuracy and confidence.

Our diversified approach allows us to be hands-on partners in shaping the future of energy and environmental products. We don’t only navigate existing markets, but also actively look for and support practical, forward-looking solutions that connect traditional commodities with a more sustainable future.

Our assets

In addition to Mercuria’s trading and financial expertise, we strategically invest in a diverse portfolio of asset companies.

Our asset base includes wholly owned entities, equity partnerships on varying levels, and partnerships where Mercuria provides financing or operational support without holding equity stake.

All these assets have in common their alighnment with the energy commodities market. They serve as crucial touchpoints, keeping us aligned to developing market trends and better serve our physical customer base.

Fervo Energy is a geothermal energy company using advanced drilling and data technologies to deliver reliable, 24/7 carbon-free power.

Our asset portfolio has evolved beyond traditional fossil fuel assets to include non-traditional energy products and strategic metals essential for renewable energy infrastructure. This strategic diversification reflects our public commitment to sustainability: by 2025, 50% of our investments will be directed toward green or renewable energy and technologies, a target we successfully reached by the end of 2022. In addition, we offset our remaining Scope 1 and 2 carbon emissions that cannot yet be abated, supporting our broader objective of achieving net-zero greenhouse gas emissions from our business operations by 2050.

This proactive approach to asset diversification is more than a response to market trends; it’s an active contribution to the global energy transition. By investing in advanced technologies and sustainable energy solutions, we envision a future where we meet our customers’ evolving energy needs responsibly and securely, both today and well into the future.

Continue reading

← Introduction

The 2030 Agenda →

Reporting areas

Governance

Planet

People

Prosperity